Risk & Compliance Advisory that equips you with the right foresight, specialist knowledge and processes to manage your exposure to risk while positioning for growth.

Today’s businesses are expected to operate within a legal framework and social licence to pursue growth and manage risk. Regulators and stakeholders are increasingly scrutinising conduct and behaviour, meaning organisations' reputations and business relationships are on the line.

We know what works, we've seen it in action

Assess and control risks with greater certainty by adopting frameworks shaped by what sticks (and what doesn’t) when under regulatory scrutiny. Our frameworks empower your team to reduce risk frequency, understand risk trends and capitalise on lessons learned across the investigations and disputes landscape globally.

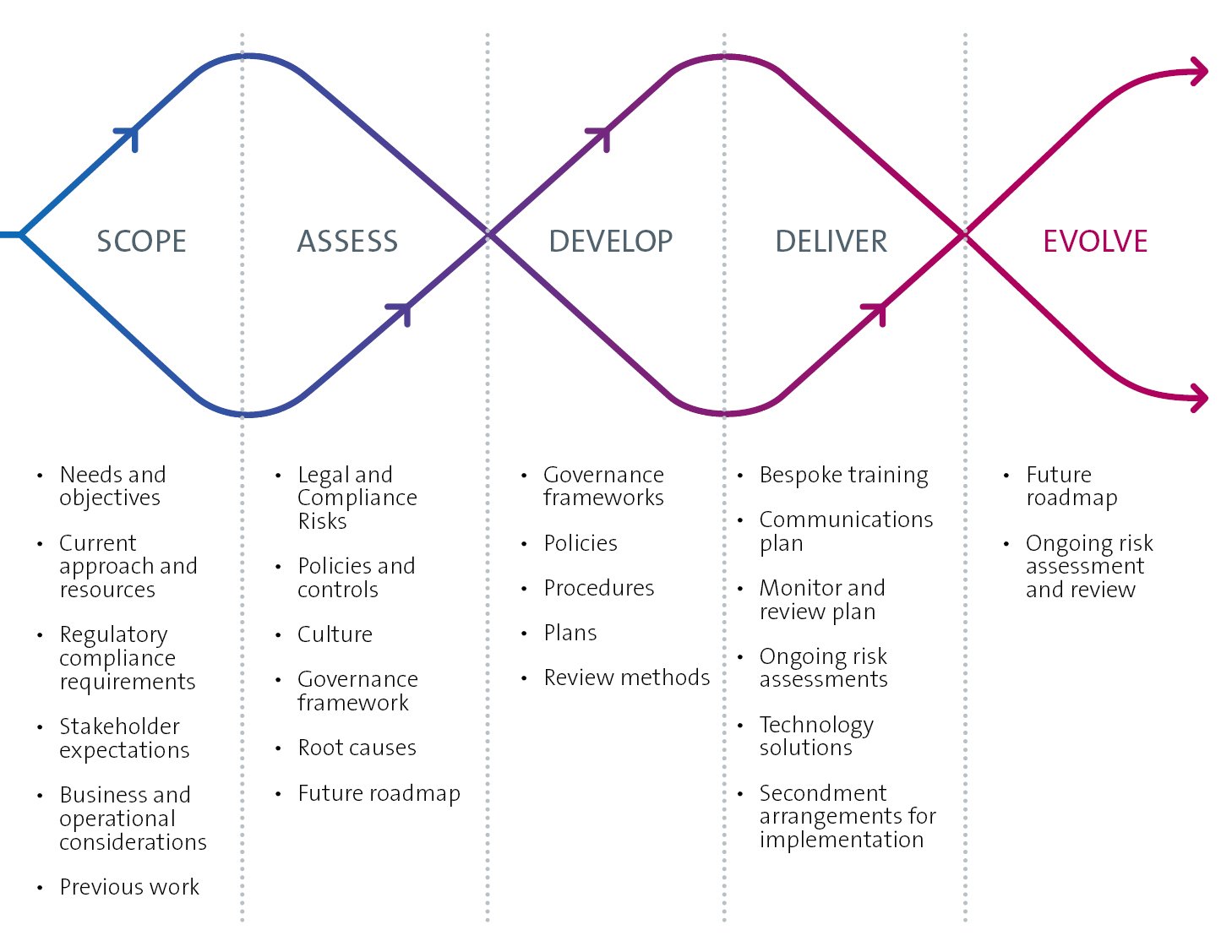

We scale our methodologies to fit your need

Reset your organisation‑wide compliance risk management approach or address only a specific area with greater confidence and certainty. We have the expertise and capacity to augment your current team and the thinking to help you manage compliance risk in this changing landscape using custom frameworks that stick across the entire organisation. In particular, managing and mitigating transnational regulatory action calls for a global track record, with Allens and Linklaters applying methodologies shaped through this lens.

We leverage technology to deliver with efficiency and precision

Achieve your compliance outcomes efficiently using our suite of tools which draw upon the expertise of our specialists across a range of areas, including business crime, competition, privacy, corporate governance, employment, technology and investigations. We help you leverage technology and training, backed by deep legal insights and best practice.

You may also be interested in

Sanctions Regime in Australia

Practical issues and steps you should take.

Risk Appetite Statements

Review of risk appetite statements and key questions to consider.

Risk & compliance frameworks and reviews

Helping you identify, assess, control and respond to emerging risks and compliance challenges.

We are experienced in establishing and developing risk frameworks and related compliance systems across a wide range of areas, and these have withstood the scrutiny of investigative authorities and regulators. Our multidisciplinary team includes technology, legal process and project management experts who work alongside our compliance subject matter experts to deliver:

- Group‑wide compliance risk assessment – understand your inherent risks and see recommendations for addressing higher risk areas across geographies and business lines.

- Compliance control design and implementation – policies, procedures and governance frameworks that meet industry and regulatory expectations.

- Business partner and third-party due diligence – understand where current business partners expose you to risk, and screen future business partners before establishing ties.

- Compliance program reviews – holistic review, including governance structures, frameworks, reporting and team structure.

- Risk register reviews – helping you escalate higher risks appropriately.

- Policy and procedure reviews – helping you ensure policies are appropriate and implemented (eg, by making them easy to understand, share, translate and be known about by the people who need to use them).

- Country entry risk assessment – best practice methodologies, independent assessments and internal messaging support to smooth the path to entering new markets.

- Culture risk assessment – understand if the ‘tone from the top’ aligns with how your policies and procedures are used on the ground.

- Whistleblower investigations design – reviewing and drafting policies and procedures, and testing the effectiveness of the policies on the ground.

- Investigations – conduct of legal or policy misconduct investigation.

- Crisis response – helping you prevent, prepare for, respond to and recover from crises (in particular via systemic reviews), creating and testing crisis readiness plans and crisis response training.

Working on risk

Case study: Risk assessment: Anti-bribery

Client outcome

Confidently demonstrate credibility to stakeholders and regulators with a refreshed Anti‑Bribery and Corruption (ABC) risk assessment process. The policy and regulatory team is now known within the business for its best practice approach to managing risk and can share insights so other teams can do the same.

Success factors

- Joint effort: developing the new ABC risk assessment methodology was a true team effort – the client, Allens and Linklaters.

- Start with a pilot: the team ran a ‘pilot’ with a BU before rollout across the group.

Scope of work

Analysis, desktop review and stakeholder engagement, and recommendations for methodology.

Case study: Reset of compliance function: Benchmarking

Client outcome

Comfort that their compliance function is aligned to industry best practice and guided by independent recommendations.

Success factors

Specific and realistic recommendations based on a broader business understanding.

This exercise needed the team to go beyond the usual gap analysis and benchmarking exercise. Having spent time and effort understanding the specific needs of the team, their stakeholders and the broader business, we were able to recommend prioritised and actionable steps that the legal and executive team could take to reset their compliance program.

Scope of work

A roadmap, view of top 10 priorities and recommended changes to the compliance function. Anti‑bribery and corruption; fraud; sanctions; privacy; insider trading; continuous disclosure; business human rights and conflict of interest.

Case study: Emerging risks: Positioning for the future

Client outcome

Better understanding of risk horizon relevant to their industry and global footprint, across a range of legal and commercial risk areas.

Success factors

Drawing on the collective insight from Allens and Linklaters – across all aspects of a business and its regulatory environment. This included project development, tax, project financing, acquisitions, climate change, social media, data privacy and cyber security, anti-bribery and competition laws to name a few.

Scope of work

Brainstorming scope with client, Allens' preparation of ‘risk status’ papers and presentations in a facilitated workshop with client leadership, in legal, risk and compliance.

Case study: Regulatory & stakeholder response: Investigation & Class Action

Client outcome

Faced with a lengthy investigation by one of its key regulators, we helped our client prepare its response and advised on its document review strategy for the hundreds of thousands of documents in the process. Our advice saved an estimated $1 million in costs.

Success factors

Close integration between our client and our legal, technology and review teams. We conducted a first pass review and data analysis, and provided consulting advice to minimise the amount of documents for review. The outcome was a cost effective document analysis and review exercise which included instant messages, emails and audio recordings. We also ensured contemporaneous reporting of key findings as the review was undertaken.

Scope of work

Ongoing strategic advice on the many complex issues which arose from the regulator's investigation and the client's own investigation, including:

- Identifying and considering the legal issues and risks, and potential resulting claims, associated with the regulator's investigation;

- Protecting the reputation of the client and its perceived ability to meet certain compliance, legal and ethical obligations;

- Preserving and, where possible, enhancing the client's relationship with the regulator conducting the investigation;

- Participating, where appropriate, in industry reviews and analysing proposed reforms which directly affected the subject matter of the investigation;

- Recognising the importance the client placed on ensuring its employees felt appropriately supported; and

- Taking into account a wide range of other risks and considerations.